Fisher Research and Insights Forefront

February 19, 2026

Marketplace

Marketplace

Tariff bills for mid-sized businesses nearly tripled since early 2025

Oded Shenkar, the Ford Motor Company Chair in Global Business Management, says mid-sized companies often don’t have the same flexibility as larger firms to switch up their supply chains amid tariff concerns.

February 17, 2026

Max M. Fisher College of Business

Max M. Fisher College of Business

Ideas and impact: Unlocking industry opportunities through academic partnerships

What happens when academic research meets real-world business needs? Associate Professor of Marketing Alice Li is collaborating with KeyBank to put evidence-based insights to work. Together, they’re exploring new marketing strategies that spark innovation, deliver measurable results and create added value for the bank and its customers.

February 10, 2026

The National Center for the Middle Market

The National Center for the Middle Market

Shaping the future of business education: A conversation with Fisher’s interim dean

The National Center for the Middle Market's Doug Farren sits down with Interim Dean Aravind Chandrasekaran to explore how Fisher College of Business is redefining business education through experiential learning, industry partnerships and forward‑looking curriculum design.

January 30, 2026

Max M. Fisher College of Business

Max M. Fisher College of Business

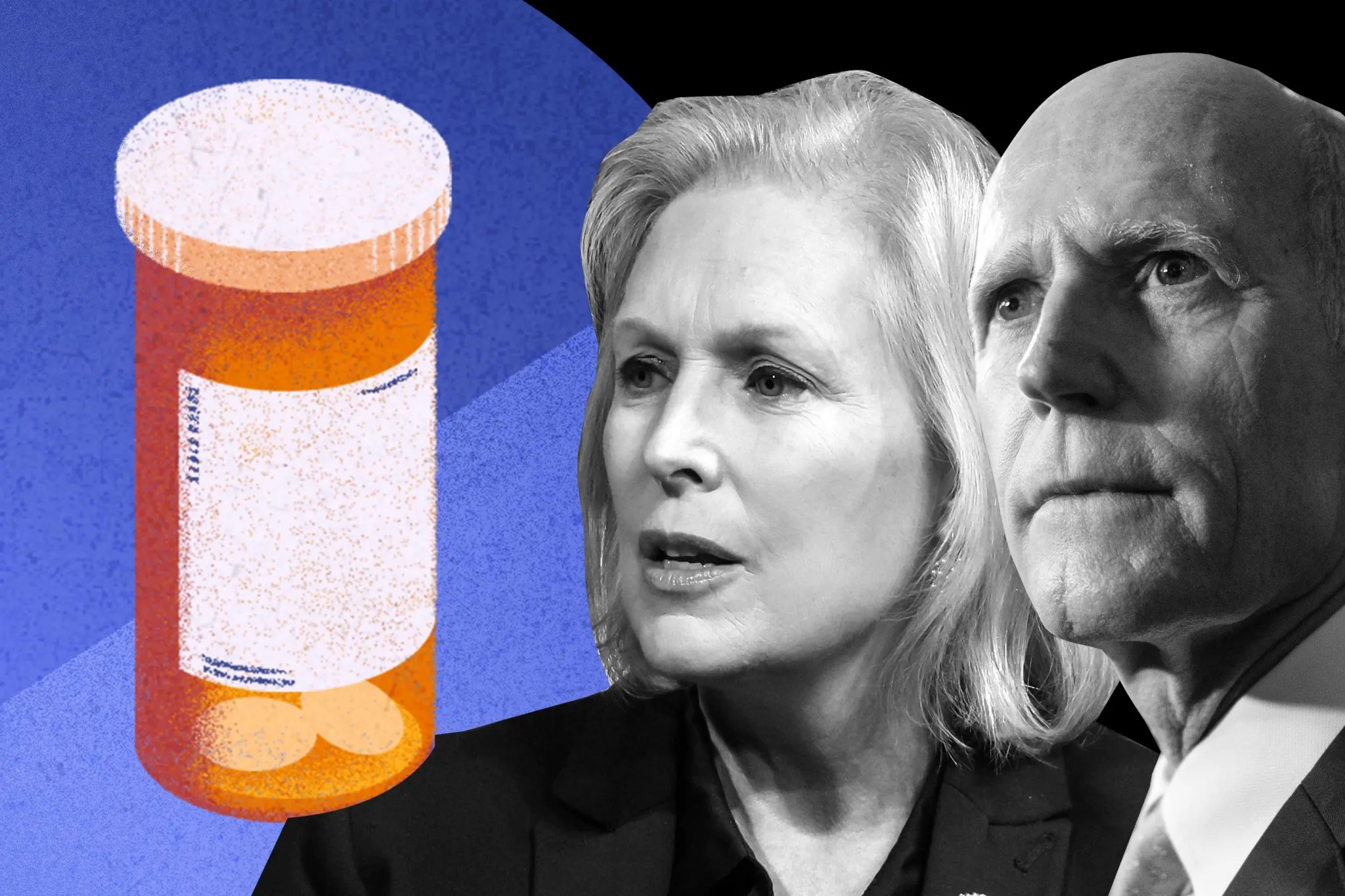

Gray’s research into pharmaceutical supply chains receives U.S. Senate audience

Professor John Gray appeared before the U.S. Senate Committee on Aging to share his insights on the risks associated with drugs made overseas. He cited the unintended side effects of these drugs due to contaminated factories and types of ingredients used as reasons that truth in drug labeling is important.

January 15, 2026

The Rational Reminder Podcast

The Rational Reminder Podcast

The rise of ETF slop

Research co-authored by Itzhak Ben-David, the Neil Klatskin Chair in Finance and Real Estate, helps explain "ETF slop," the explosion of complex, high-fee, behaviorally engineered ETFs that are designed to attract assets rather than improve investor outcomes ― and why they're not always the best investment vehicles.

December 23, 2025

RealClear Markets

RealClear Markets

Private credit's expanding role in the middle market

Doug Farren, executive director of the National Center for the Middle Market, writes about the impact that private credit is having for middle market companies and the sector as a whole.

December 17, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

Hu’s research into AI in business earns prestigious award

Yuheng Hu, a distinguished associate professor in the Department of Accounting and Management Information Systems, earned recognition for his research into human-AI interaction and its impact on business decisions and societal outcomes.

December 12, 2025

The Conversation

The Conversation

Donor-advised funds have more money than ever – and direct more of it to politically active charities

When foundations make grants to donor-advised funds, the digital trail normally created to track the funds instead becomes a dead end, which is problematic regarding transparency, writes Brian Mittendorf, the H.P. Wolfe Chair in Accounting at Fisher.

December 9, 2025

The Times of London

The Times of London

Why people forgive a late gift but not a forgotten one

Research by Fisher faculty members Grant Donnelly and Rebecca Walker Reczek, along with PhD candidate Cory Haltman found that gift-givers overestimate the negative impact of a tardy present. The real misstep, they say, is not to send one at all.

December 5, 2025

The Wall Street Journal

The Wall Street Journal

The surprising (and reassuring) truth about late presents

Gift givers think it’s the ultimate faux pas. But research from Fisher's Grant Donnelly, Rebecca Walker Reczek and PhD graduate Cory Haltman suggests that those on the receiving end don’t mind nearly as much as we fear.

December 3, 2025

Barron's

Barron's

Star-powered ETFs are luring investors. But a big name doesn’t guarantee big returns.

Research co-authored by Itzhak Ben-David, the Neil Klatskin Chair in Finance and Real Estate, cautions investors that attention-grabbing ETFs may not always be sound investments. The 2022 study showed that thematic funds lost about 30% of their risk-adjusted value five years after launching.

November 25, 2025

PBS News

PBS News

How artificial intelligence is reshaping college for students and professors

Ohio State isn’t just wrestling with generative-AI in classrooms — it’s embracing it. With its ambitious AI Fluency initiative, every Buckeye (eventually) will graduate AI-savvy and AI-responsible, taught not only by research teams but by leaders like Lori Kendall, a senior lecturer at Fisher.

November 25, 2025

The Ohio State University

The Ohio State University

Sharpening generations of legal and business minds

From business to law, the Reese family's support of The Ohio State University is boundless. Learn more about their impact and how Fisher faculty member René Stulz is upholding this strong tradition through his work as a world-renowned finance scholar.

November 24, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

Fisher announces new appointments to endowed chairs and distinguished professorships

Fisher celebrates eight faculty leaders appointed to endowed chairs, professorships and distinguished honors — recognition of their outstanding research, teaching and service that continue to strengthen Fisher’s academic excellence and impact across business education and industry partnerships.

November 21, 2025

Fisher College of Business

Fisher College of Business

Tinsel, tidings and tariffs: Middle market insights for the holidays

Between Main Street’s small shops and the global retail giants lies the U.S. middle market — a powerful yet often overlooked engine of one-third of the nation’s economy. As holiday spending ramps up, Doug Farren, executive director of the National Center for the Middle Market, shares some timely insights into what’s happening behind the scenes — and what it means for consumers this season.

November 19, 2025

WJLA

WJLA

Deadly consequences of U.S. reliance on Indian-made drugs

Research by John Gray, the Dean’s Distinguished Professor of Operations at Fisher, found a 54% higher likelihood of "severe adverse events," including hospitalization, disability and death, tied to generic drugs made in India versus in the U.S. He's advocating for more transparency on where medicines are manufactured and by whom.

October 31, 2025

Middle Market Growth

Middle Market Growth

What new research says about PE’s impact on midmarket businesses

A special report from the National Center for the Middle Market (NCMM) dispels some myths about private equity’s impact on middle-market businesses and offers some hard data on how PE-backed companies perform compared to their counterparts. NCMM’s Executive Director Doug Farren talks about the research findings, and what it means for both middle-market companies and the PE firms that hope to invest in them.

October 27, 2025

ProPublica

ProPublica

Senators propose sweeping changes to generic drug oversight

A study by John Gray, the Dean’s Distinguished Professor of Operations at Fisher, found that some Indian-made generic drugs are linked to more adverse events than U.S. versions. It prompted calls for increased FDA testing and alerts when foreign manufacturers with safety issues are allowed to ship to U.S. hospitals.

October 14, 2025

The Ohio State University

The Ohio State University

AI’s growing impact in education, business focus of Ohio State conference

Fisher's inaugural event brought together academic researchers and practitioners to explore how successful adoption of AI technology will rely heavily on how it intersects with human thought.

October 13, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

From burgers to diamonds: How challenges nudge us toward ethical choices

Ethics alone won’t convince consumers to choose sustainable products. Research by a trio of Fisher faculty, led by Senior Lecturer Maria Landekhovskaya, reveals that challenging consumers to spot the difference in products is a strong incentive to try — and buy.

October 10, 2025

Columbus Business First

Columbus Business First

On AI, Ohio State goes for bold

A look at the bold, wide-ranging effort to ensure all Ohio State students are AI fluent by the time they graduate, including all the ways Fisher is building on a strong foundation of AI adoption.

October 9, 2025

Success

Success

Music at work: When it helps and when it hurts

Music in the workplace is more than just background noise. When it aligns, it can boost focus and morale — but when it misfires, it drains energy and saps attention, according to new research by Kathleen Keeler, assistant professor of management and human resources.

September 15, 2025

MarketWatch

MarketWatch

Private equity in your 401(k): Who is the big winner? Probably not you.

A recent study of the investment performance of individuals who had invested in private-equity funds found that, if anyone made out like a bandit from this industry, it was the investors who were already rich. The study, co-authored by Assistant Professor of Finance Petra Vokata, found that these individuals either got into the best funds, or they had the best advisers, or both.

September 14, 2025

Radio Health Journal

Radio Health Journal

Cheap drugs have a high cost: The safety issues of generic prescriptions

John Gray, the Dean’s Distinguished Professor of Operations at Fisher, discusses his research into regulatory differences between the production of pharmaceuticals domestically and internationally ― and the safety issues they raise for consumers.

September 9, 2025

Newsweek

Newsweek

Product recalls are on the rise, top causes revealed

John Gray, professor of operations and business analytics at Fisher, says oversight of foreign pharmaceutical manufacturers could be one reason for the recent surge of medicine recalls.