Fisher Research and Insights Forefront

August 25, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

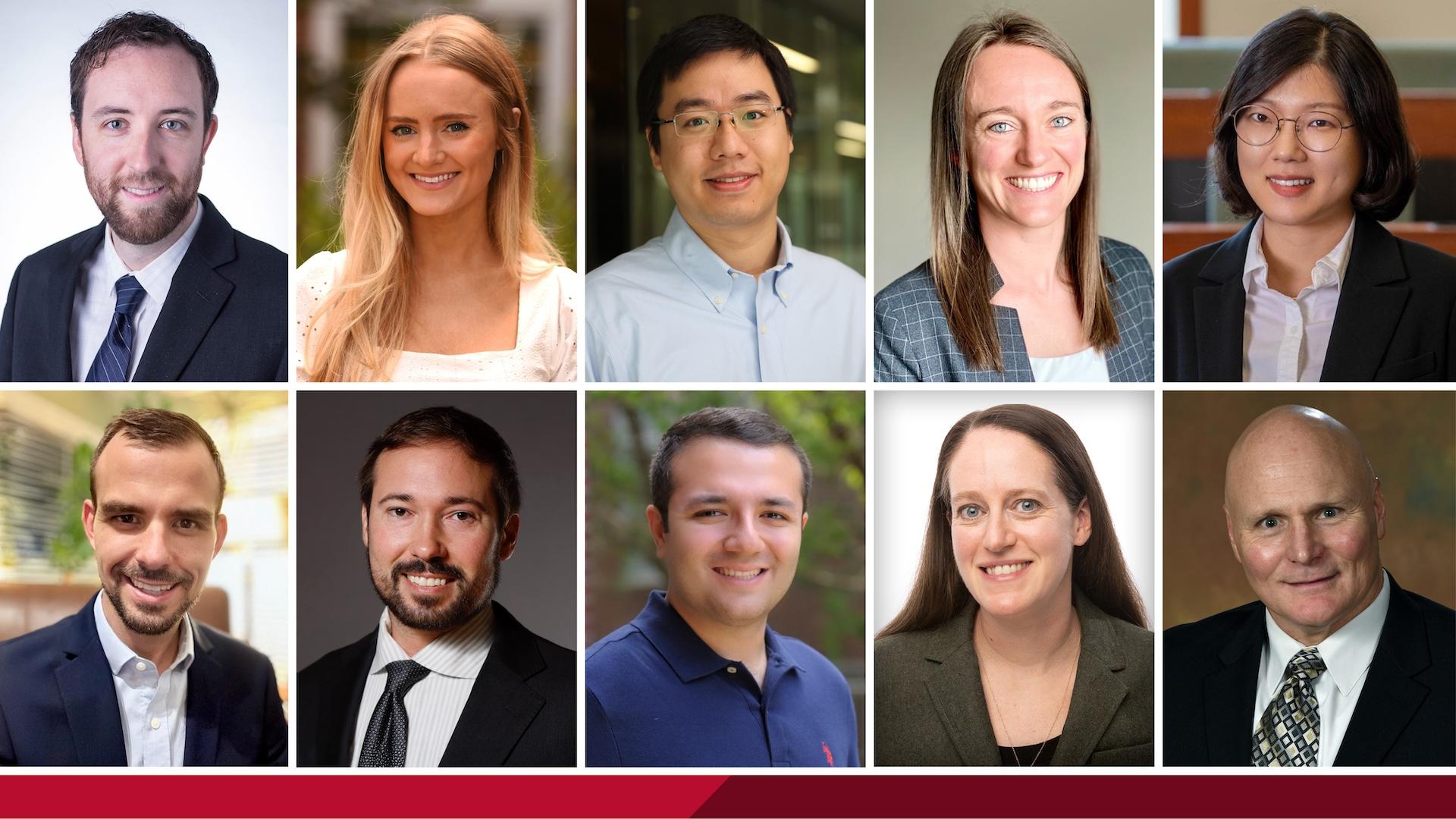

Introducing Fisher's new 2025 faculty

Meet the newest faculty members who are bringing their research, business backgrounds and teaching experience to Fisher students for the 2025 academic year.

August 22, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

What can billiards teach us about business competition?

Like a cue ball that transfers energy to other balls in billiards, a dominant player in business can reshape a market. Research by Professor Richard Makadok uses the “cue-ball effect” to illustrate how companies with a competitive advantage can impact an entire industry.

August 19, 2025

The New York Times

The New York Times

Economic data has taken a dark turn. That doesn’t mean a crash is near

Inflation is up and job creation down, but the U.S. economy could still pull through without too much pain. The next few months will be pivotal in illustrating whether actions taken by companies will reflect data gathered by the National Center for the Middle Market (NCMM) showing that business leaders were anticipating the lowest revenue and employment growth of the post-pandemic period.

August 18, 2025

MarketWatch

MarketWatch

Is Nvidia a Republican or a Democrat? These political ETFs have voted.

ETFs that combine investing and politics are tapping into investors’ polarized views. But should they get your vote? Research by Itzhak Ben-David, the Neil Klatskin Chair in Finance and Real Estate, says no. Ben-David suspects that specialty ETFs focus on narrow investment themes such as politically niche offerings primarily for marketing purposes to justify their high expense ratios.

July 10, 2025

TIME

TIME

America’s best midsize companies of 2025

Who better to provide context about top middle market companies than Doug Farren, the executive director of the National Center for the Middle Market? Farren explains the middle market's outsized influence on the U.S. economy, areas that are surging and challenges faced by middle market companies.

June 25, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

Exploring a century of global conflicts and their impact on financial assets

Against the backdrop of the Russia-Ukraine war and Middle East conflicts, a trio of Fisher faculty are providing insights into how geopolitical uncertainty shapes financial assets ― and how markets are driven not just by what happens, but by what investors fear might happen.

June 24, 2025

WOSU

WOSU

How have gas stations grown and affected our current way of life?

Brian Hipsher, senior lecturer in marketing and logistics, discusses the proliferation and impact of convenience stores such as Buc-ee's, Sheetz and Wawa.

June 18, 2025

The Ohio State University

The Ohio State University

Credit scores of corporate executives may reveal their decisions

A new study conducted in partnership with the National Center for the Middle Market reveals just how influential personal credit scores of corporate executives are in their overall decision making and risk tolerance. The research was published by a Noah Dormady and Yiseon Choi at the John Glenn College of Public Affairs.

June 13, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

Research productivity drives Fisher’s rise in key rankings and measures

Fisher College of Business climbed in global research rankings, placing 25th in the world, 23rd in North America and 11th among public universities according to new rankings released by UT-Dallas. Fisher's research productivity among Financial Times journals, as well as among top American Marketing Association journals also increased.

June 4, 2025

Barron's

Barron's

The best way to respond to a geopolitical crisis

Working research from Fisher's Andrei Gonçalves, Alessandro Melone and Andrea Ricciardi is offering investors better insights on how to respond to geopolitical crises, such as war and military conflict.

June 1, 2025

Business Insider

Business Insider

One of the most attractive — and sometimes secretive — ways the wealthy donate money could soon get even more popular

A provision in President Trump's tax bill could make donor-advised funds (DAFs) an even more popular form of giving, but they're not without potential problems. Fisher Professor and Nonprofit Expert Brian Mittendorf and his colleague, Helen Flannery, an associate fellow at the Institute for Policy Studies, found through a study that DAFs distribute grants to politically engaged organizations 1.7 times more than other funders.

May 22, 2025

the Giving Review

the Giving Review

Donor Advised Funds: A conversation with Helen Flannery and Brian Mittendorf

Nonprofit accounting expert Brian Mittendorf joins Helen Flannery, associate fellow at the Institute for Policy Research, to discuss the potential legal and regulatory reforms of donor-advised funds.

May 21, 2025

Harvard Law School Forum on Corporate Governance

Harvard Law School Forum on Corporate Governance

Climate boards: Do natural disaster experiences make directors more prosocial?

A National Bureau of Economic Research working paper co-authored by Department of Finance Chair Bernadette Minton and colleagues Sehoon Kim (PhD '17) and Rohan Williamson (MA '96, PhD '97) explores whether and how the actions of corporate leaders with past experiences dealing with abnormally devastating natural disasters are influenced by those disasters.

May 20, 2025

Max M. Fisher College of Business

Max M. Fisher College of Business

Stories, strategies and science steer inaugural leadership conference

Building on Ohio State’s 85-year history of scientific leadership research, the Fisher Leadership Initiative hosted more than 200 professionals for a unique opportunity to assess their personal leadership styles and hear from storytellers, peers and behavior experts at the inaugural Conference on Principled Leadership.

May 19, 2025

WalletHub

WalletHub

What is a budget?

Cynthia W. Turner, Fisher's associate dean of access, engagement and outreach, and an accounting professor, outlines some budget basics.

May 13, 2025

WalletHub

WalletHub

Changes in inflation by city

To gain a deeper understanding of current inflation trends and what they mean for our economy, WalletHub turned to a panel of experts, including Sergey Sarkisyan, assistant professor of finance.

May 13, 2025

WalletHub

WalletHub

Changes in inflation by city

To gain a deeper understanding of current inflation trends and what they mean for our economy, WalletHub turned to a panel of experts, including Sergey Sarkisyan, assistant professor of finance.

May 13, 2025

MoreSteam

MoreSteam

Managing change with Dr. Larry Inks

Professor of Management and Human Resources Larry Inks discusses why one clear goal keeps a team focused. He also explores change management, including the emotional aspects of change, and the differences between management and leadership.

May 9, 2025

The Conversation

The Conversation

Can Trump strip Harvard of its charitable status? Nonprofit scholars describe the obstacles

The Conversation U.S. asked Philip Hackney, a nonprofit law professor who previously worked in the office of the chief counsel of the IRS, and Fisher's Brian Mittendorf, an expert on nonprofit accounting, to explain what it would take for the federal government to revoke a university’s tax-exempt status.

May 5, 2025

Harvard Business Review

Harvard Business Review

What to share, What to hold back

Self-disclosure at work can build trust and connection, but it also carries risks — especially for women, leaders, and those whose values or identities set them apart. Tracy Dumas, professor of management and human resources, joins the conversation to talk about human connection in the workplace.

April 29, 2025

The Ohio State University

The Ohio State University

National champion Mike Doss shares how Buckeyes prepared him for business success

National champion Buckeye Mike Doss (MBOE '19) returned to Fisher and the Center for Operational Excellence (COE), delivering a keynote at the 2025 COE Summit, where he shared lessons from his time on the football field ― and his journey back to Ohio State.

April 26, 2025

Fortune

Fortune

Senior leaders are up to 12x more likely to be psychopaths — how to spot an abusive boss

Do you view your toxic boss as successful? This perspective makes you more likely to label their abuse as “tough love,” according to a study published by faculty from Fisher's Department of Management and Human Resources.

April 9, 2025

Fisher College of Business

Fisher College of Business

Is giving a late gift really that bad?

New research from Fisher says that we’re probably overestimating the importance of when we give a gift. Watch as marketing faculty Grant Donnelly, Rebecca Reczek and Cory Haltman explain their findings while also testing their gift-wrapping skills.

April 8, 2025

The Ohio State University

The Ohio State University

Engaged Scholars: Andrea Contigiani

Andrea Contigiani, assistant professor of management and human resources, is committed to researching the power of entrepreneurship to help refugee communities. His research was recently named a Program of Excellence in Engaged Scholarship by Ohio State's Office of Outreach and Engagement.

April 7, 2025

The Ohio State University

The Ohio State University

‘Ugh, not that song!’ Background music impacts employees

New research from Kathleen Keeler, assistant professor of management and human resources, finds that performance suffers when workplace music is a misfit for workers' needs.