SMF Curriculum

The Specialized Master in Finance (SMF) program totals 36 credit hours over three semesters, allowing students time to build strong analytical skills through core coursework and foundational electives, master their learning through action-based experiences and a summer internship, and enhance their knowledge of finance through advanced specialty electives.

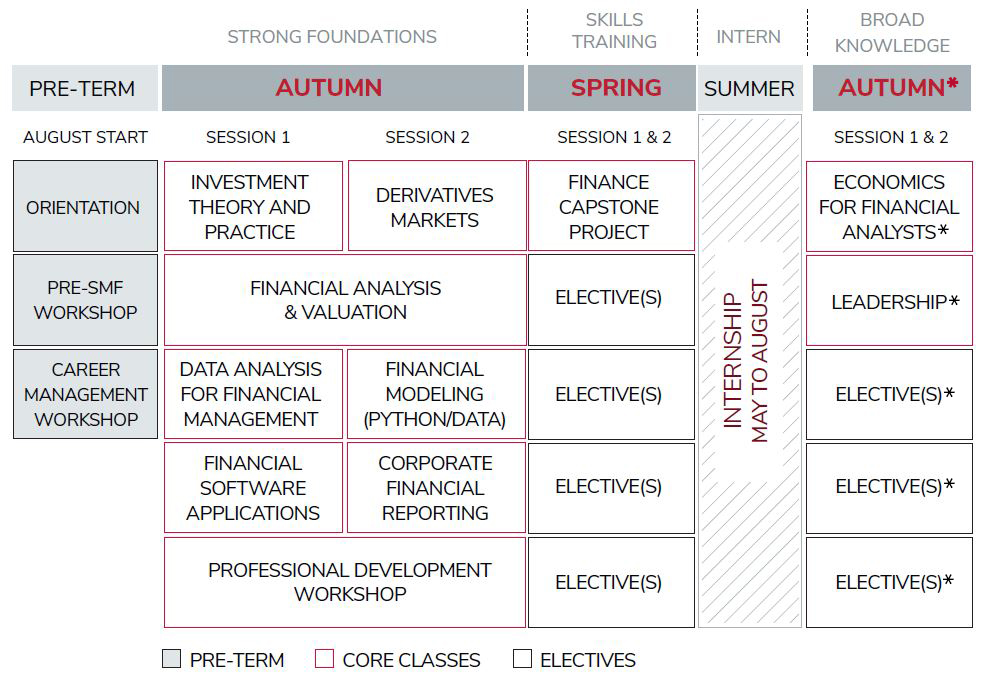

SMF Curriculum Overview - Three semesters (16 months)

Pre-Term

August Start

- Orientation

- Bootcamp (Preparatory Workshops)

- Career Management Workshops

Autumn (Strong Foundations)

Session 1 & 2

- Data Analysis for Financial Management

- Financial Analysis & Valuation (full semester course)

- Investment Theory and Practice

- Financial Software Applications

- Derivatives Markets

- Corporate Financial Reporting

- Financial Modeling (Python / Data)

- Professional Development Workshop (full semester course)

Spring (Skills Training)

Session 1 & 2

- Finance Capstone Project

- Elective(s)

Summer (Intern)

Internship May to August

Autumn (Broad Knowledge)*

Session 1 & 2

- Leadership*

- Economics for Financial Analysts*

- Elective(s)*

*NEW! Online Option for Final Semester

Domestic students entering the program in autumn 2026 or later will have the option to complete the third and final semester online. Students will need to complete 13.5 credit hours in the first autumn semester, 13.5 credit hours in the spring semester, and 9 credit hours of online coursework in the final autumn semester.

Credit Hour Requirements

18 Core Credit Hours

18 Elective Credit Hours

36 Total Credit Hours Required

Note: International students must take at least 8 of their required 36 credit hours in the final semester. 18 is the maximum per semester.

*NEW! Online Option for Final Semester

Domestic students entering the program in autumn 2026 or later will have the option to complete the third and final semester online. This new program enhancement allows students to enter the workforce sooner while completing program requirements from anywhere in the U.S.

Students interested in exercising this option will need to complete 13.5 credit hours in the first autumn semester, 13.5 credit hours in the spring semester, and 9 credit hours of online coursework in the final autumn semester. The first autumn semester and spring semester are in-person only without exception.

- Q: Who is eligible for online flexibility for the final semester in the SMF program?

- A: This option is available only to domestic students who enter the SMF program in autumn 2026 or later.

- Q: I will be in Columbus during the final semester but would like to take some classes online. Am I able to mix online and in-person courses?

- A: If you will be in Columbus, Ohio, you can mix online and in-person courses in the final semester. However, you still need to complete a minimum of 9 credit hours in the final semester. Students are encouraged to consult with their academic advisor if they prefer to mix online and in-person courses in the third semester.

- Q: Can I complete the entire program online?

- A: No. Only the final semester may be completed online. The first two semesters must be completed in person.

- Q: How many credit hours must I complete each semester to use this option?

- A: To qualify, students must follow this credit‑hour structure:

- Autumn (Year 1): 13.5 credit hours

- Spring (Year 1): 13.5 credit hours

- Final Autumn (Year 2): 9 credit hours online

- Q: How will online flexibility in the final semester benefit me?

- A: The online final semester is intended to support earlier entry into the workforce, allowing students to extend summer internships or begin full‑time roles while completing remaining coursework.

- Q: Can I complete more than 9 credit hours online in the final semester?

- A: Students that select the third semester online pathway will be able to take 9 credit hours of online coursework. There is no guarantee that students will be able to take additional credit hours online.

Curriculum details

Core coursework builds a strong foundation.

First-semester core coursework builds a strong business foundation in finance, accounting, quantitative analysis, and software skills, leading to specialization electives during the spring semester as students pursue their search for a summer internship. Core coursework also includes training in financial analysis and valuation, investments, financial derivatives and more.

By following a lock-step program of study in the autumn with fellow SMF students in a diverse teamwork environment, students also develop valuable soft skills for future careers. Required training is supplemented through customized coursework in soft skills, professional development, and action-based experiences.

Quantitative Skills and Software Training

Quantitative Skills and Software Training

Three required core courses build fundamental skills in quantitative and data analysis, financial software tools and financial modeling with Excel. This includes exposure to software tools and applications with real data, such as:

- Bloomberg

- Capital IQ

- Python

- Financial Modeling with Excel

Career-focused, customized elective pathways.

At the end of the first semester, SMF students select a specialization area and complete a customized study plan for a minimum number of foundational and specialty electives. Students can specialize in Corporate Finance / Investment Banking, Investment Management, Risk Management & Insurance, or Real Estate.

The spring semester focuses on foundational electives in a given area to prepare for internships. The final semester covers some remaining core classes (for example, a customized course in economics for financial analysts and leadership), more advanced topics, and knowledge of broader interests with a targeted career path. Students who desire to broaden their understanding of business-related topics outside finance, such as Data Analytics, Strategy, Urban Planning, Public Policy or Environmental Studies, can take more electives upon consultation.

- Develop expertise and attract employers in a specific finance area

- Take some elective classes with MBA and other Fisher grad students

- Gain technical and analytical skills to succeed in a summer internship

- Expand key broad knowledge for your future career as a leader

- Building institutional knowledge with immersions (visits, industry professionals, alumni)

Specialization Tracks

Interested in investments? consider the Student Investment Management (SIM) elective, where students engage in group decision-making while gaining real-world portfolio management experience with the existing SIM portfolio.

Looking for even more? SMF students also have the opportunity to select additional graduate-level electives offered through the Fisher College of Business. Some popular electives include:

- Machine Learning and Artificial Intelligence*

- FinTech*

- Tools for Data Analysis (introduction to R)

- Data Analysis and Visualization (introduction to Tableau)

- Negotiations

*FinTech Micro-Credential: If you take Machine Learning and Artificial Intelligence and Fintech (4.5 credit hours), you can earn Fisher's FinTech Micro-Credential while in the SMF degree program. This is a great way to add something additional to stand out in the job market.

Additional electives are available to SMF students upon consultation with their Academic Advisor and the SMF Director.

Grow through soft skills training, speakers, and immersions.

Under the guidance of faculty, a customized professional development course is woven throughout the first year to strengthen professional skills in preparation for your summer internship (and career). This course covers career management and internship search training, alumni and professional networking events, a speaker series, and customized immersion experiences by area of specialization involving company visits and engagement with professional organizations.

- Master valuable soft skills in:

- networking

- teamwork and leadership

- project management

- professional presentations

- and more

Through the required Finance Capstone Project, all SMF students practice analytical and soft skills by tackling a customized team project under faculty guidance during the spring semester of their first year. Faculty explain the scope of the project and set expectations for deliverables. Students manage the project under faculty guidance and supervision and complete their work by making a professional presentation. This first-year, capstone experience will polish your skills as you prepare to start your summer internship.

This experience, combined with team projects in courses, spark innovation and sharpen analytical, technical, and soft skills. At Fisher, we're focused on preparing you for a summer internship and post-graduation career.

Through the rigorous financial training and extensive team projects that fostered a hands-on learning experience, I can honestly say I have never been more prepared to meet uncertainty and tackle real-world problems.

Continue your growth outside the classroom.

Outside of the classroom, strengthen your understanding of finance and broaden your professional network through the Applied Finance Speaker Series, Fisher's affiliations with the Columbus CFA Society, Fisher’s Risk Institute and Center for Real Estate. Through these partnerships and more, students participate in:

- Industry field trips and graduate global programs

- Case competitions

- SMF Speaker Series

- SMF alumni mentor program / Professional development

- Engage in an open dialog with seasoned professionals across the University and the community

- Ohio State Student Organizations

- Fisher Student Organizations

- Engage Fisher Centers: To broaden your understanding of finance and learn from professionals, you will be encouraged to affiliate with Fisher’s Centers, such as Risk Institute, Center for Real Estate, and National Center for the Middle Market.

- Join the CFA Society of Columbus as a student member

Program structure: On-campus, full-time

The 36-credit-hour STEM-designated SMF program is offered entirely in-person and on campus. Courses are delivered in one of two formats:

- 14-week semester courses (typically 3 credit hours per class) or

- 7-week session courses (typically 2.5 or 1.5 credit hours per class)

Before the program starts, all students must attend orientation and pre-term training. Once the school year begins, most courses last 7 weeks, allowing you to experience a wider variety of coursework. Typically, SMF students do not take more than 15 credit hours per semester. However, students may take a maximum of 18 total credit hours per semester. The first autumn semester consists of only required coursework.

Preparation for Professional Certification

SMF students are well-prepared and encouraged to sit for the Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), and/or Chartered Alternative Investment Analyst (CAIA) professional designations and can customize their program of studies to prepare themselves for these examinations.

SMF students are well-prepared and encouraged to sit for the Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), and/or Chartered Alternative Investment Analyst (CAIA) professional designations and can customize their program of studies to prepare themselves for these examinations.

As a CFA Institute partner, the Specialized Master in Finance (SMF) program covers 70% of the Chartered Financial Analyst (CFA) program Candidate Body of Knowledge (CBOK).

Fisher's CAIA Association Partnership

Fisher's CAIA Association Partnership

Fisher's Chartered Alternative Investment Analyst (CAIA) Association partnership provides students with expanded access to educational tools, and a network of professionals in the hedge fund, private equity, real estate, endowment and more. Discover the benefits.