A guide to 9 Master-Level Accounting Courses at Fisher

Hi everyone,

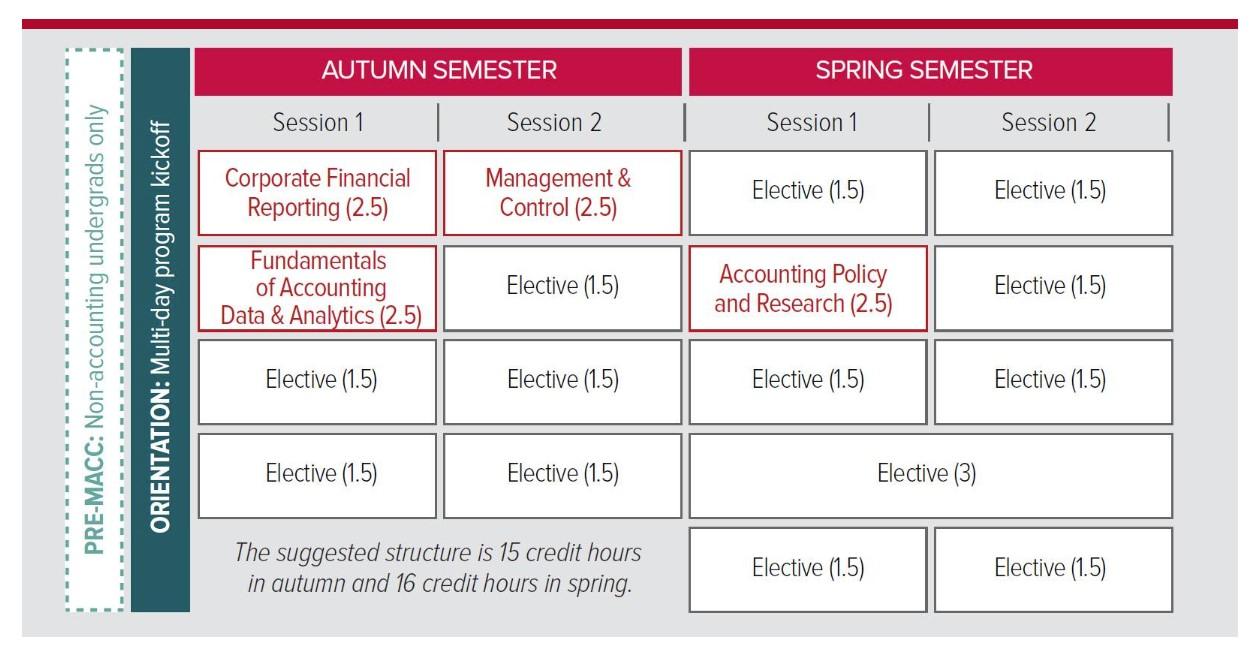

In this blog post, I will share my experience with the nine graduate-level courses Fisher's Department of Accounting & Management Information Systems (AMIS/ACCTMIS) offers. If you have already accepted the offer for the Master of Accounting Program at Fisher and are figuring out your class schedule for Fall 2023, I hope this blog will be helpful. Let's start with the four core courses:

- ACCTMIS 6000 - Management & Control: Consider this course an extension of your Managerial/Cost Accounting course; you will also learn more about real-world managerial implications.

- ACCTMIS 6001 - Fundamentals of Accounting Data & Analytics: This course will review some basic statistical concepts and help you see how the statistics tools, such as RStudio, can help accountants/auditors when dealing with "Big Data." (If you want to dig deeper, pick BUSOBA 7256 - Tools for Data Analysis as one of your electives, and I will share more details about BUSOBA 7256 in my next blog post).

- ACCTMIS 6200 - Financial Reporting: Similar to ACCTMIS 6000, Consider this course an extension of your (Intermediate) Financial Accounting course(s); you will learn from many cases to help you better understand topics, such as revenue recognition and lease accounting.

- ACCTMIS 6202 - Accounting Policy & Research: This course will expose you to some research topics, such as event studies, earnings management, and auditing. More importantly, it will improve both your verbal and written communication.

Now I want to focus on some accounting electives that I am taking. Since I didn't major in Accounting as an undergraduate student, many of my elective courses are introductory by nature.

- ACCTMIS 7500 - Auditing Principles and Procedures: This is an accelerated version of the introduction to audit primary for students who have never taken an audit course before. However, you can still take this course to review some key concepts.

- ACCTMIS 7510 - Assurance Services and Information Quality: Take this course to learn more about how auditing/assurance interacts with the accounting information system and the new technology.

- ACCTMIS 7520 - Fraud Examination: Misappropriation of Assets: This is a very case-based course, and you will get exposure to concepts and around 10 Fraud-Related Cases within only seven weeks.

- ACCTMIS 7400 - Tax Planning for Managerial Decision Making: Similar to ACCTMIS 7500, consider this course a tax introduction. If you want to learn more about tax, you can take Tax Research, Tax 2, and Tax 3, and I will mention all three courses in detail in my next post.

- ACCTMIS 7250 - Governmental and Non-Profit Accounting: This course will help you prepare for the FAR section of the CPA exam to some extent, and you will be able to hear many guest speakers talk about their real-world experience regarding Governmental and Non-Profit Accounting.