The Semester of Electives Part 1

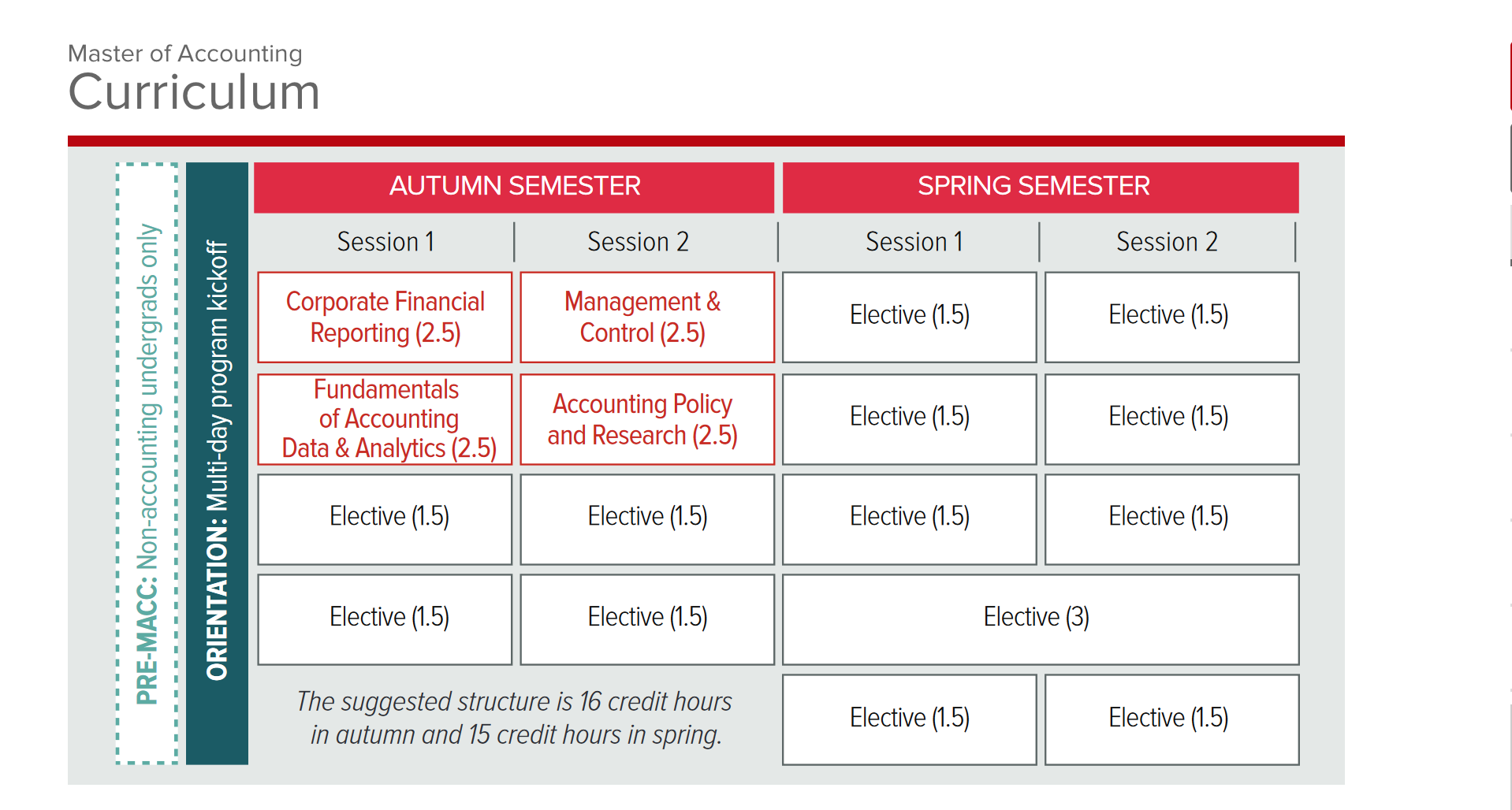

One of the most exciting parts of the Master of Accounting (MAcc) program is all the elective options for the second semester. There is only one 2.5 credit hour class required as part of the general program during the semester, with the rest being up to each student's choice. In this blog post, I will walk through the elective choices I made for the first session of classes. Keep an eye out for another blog post during the second session about those classes.

Tax 2

When reviewing the course offerings for the spring semester, it was apparent that I was going to take Tax 2. I took Tax 1 in my undergraduate studies, but we only learned about the taxation of individuals and partnerships in that class. In Tax 2, we learn all about the taxation of corporations, and since I am working in corporate tax after graduation, I knew this was a class that would interest me.

Government and Nonprofit Accounting

Government and Nonprofit Accounting is required for combined BSBA/MAcc students, but I would have taken it anyway, given its relevance to the CPA exam. The first half of the class reviews the GAAP and IRS rules about nonprofit organizations, and the second half of the class reviews accounting rules associated with government organizations. It's a very interesting class, and the professor who teaches it is incredibly knowledgeable and engaging. He brings a lot of examples into class. For instance, one of our projects for the semester was reviewing the financial statements of different US Olympic teams in preparation for the 2022 Winter Olympics.

Logistics Management

When looking over my schedule, I saw that I was planning on mainly taking accounting courses, and I thought it would be fun to break that up with a class from a different department. I have friends who are logistics majors, so I decided to take Logistics Management. The class has been a great way to introduce new topics into my coursework and help me become a more well-rounded business student. The class is exciting since the professor often incorporates research he completed and is incredibly knowledgeable about.

Fraud Examination: Misappropriation of Assets

I decided to take Fraud Examination due to the intriguing subject matter of the course. As part of the course, we review real-life fraud cases and deconstruct how they happened and how they could have been prevented. It is so cool that I can look up and find the things we are studying in the news. The course is very content-heavy, but it is easy to want to learn since we get to see its real-world application so clearly.